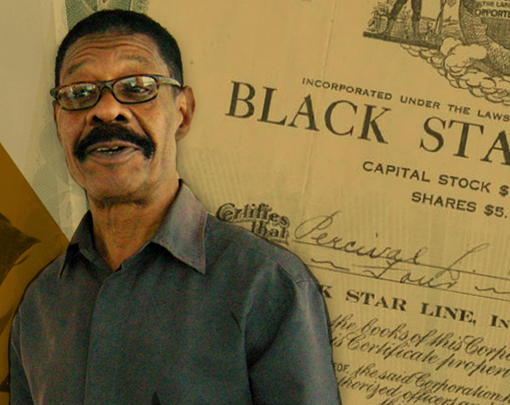

On this episode of the Next System Podcast, Rev. Dr. Delman Coates discusses “The New Abolitionism: The Campaign for Monetary Freedom,” a program that seeks to empower people with knowledge about the monetary system and how it could be used to promote the public good.

Subscribe to the Next System Podcast via iTunes, Soundcloud, Google Play, Stitcher Radio, or RSS.

Adam Simpson: Welcome to the Next System Podcast, today’s subject is “The New Abolitionism,” a campaign that confronts the role of money and debt in American society. Talking about the campaign is Rev. Dr. Delman Coates, the senior pastor of Mt. Ennon Baptist Church, and founder of New Abolitionism. Welcome to the Next System Podcast, Pastor Coates.

Delman Coates: Thank you so much, Adam. Thank you, I’m really excited to be on there.

Adam Simpson: Great, and we’re glad to have you. In your own words, how would you describe The New Abolitionism, the campaign for monetary freedom, and how did this campaign come about?

Delman Coates: Well the New Abolitionism campaign is really fundamentally about educating the public about the need to reclaim the power to issue the nation’s money. Most people in society take money for granted, but what we fail to realize is that 97% of what we use as money is created by private banks as a debt to society. At every level, at the governmental level, federal, state, local governments have to borrow in order to fund public priorities, schools, roads, jobs, infrastructure, healthcare, and a range of other needs that the governments provide for corporations, individuals. In order for them to have money—or the medium of exchange—it comes into existence or it is created as a debt.

It’s important for me to distinction money creation from money lending. We’re talking about money creation. 97% of what we use as money is created as a debt. Why is that so critical and important? It’s important because when banks issue money as a debt, the principal amount of money is put in circulation, but not the interest portion of money. It’s very important for people to understand the way in which a debt-based money system creates money scarcity. I’ve written about this in places like the Huffington Post, in which I give this example: I invite people to imagine 10 people in a community… Let’s imagine those 10 people are issued $1000 that they have to pay back at some arbitrary interest rate, let’s just say 10% for conceptual purposes. Well there’s $10,000 in their money supply, in their economy, in circulation, but they owe $11,000. That extra interest portion of money is not in circulation.

I would contend, and many other macro economists and activists would contend that there’s no amount of legislation, education, programs, taxation, marches, rallies, charity, or prayer that can account for this monetary scarcity. The suggestions of some purists who say, well depending upon the velocity of money, that it is possible to conceive interest payments being made if everyone doesn’t have to owe their money back at the same time, it’s possible to imagine interest being paid in a money scarce environment. There are deep, fundamental problems with that perspective. I would contend that a debt based money system is structurally unsustainable. There have been economists going all the way back to 1934 with the Chicago Plan to stabilize the banking and monetary system after the Great Depression, who have said that the instability of our economy is caused and created by the power given to banks to create money today.

The New Abolitionism is about the public reclaiming that power. Why should the government issue treasury bonds when it can just issue real money to fund schools, roads, jobs? As a consequence, the government would not have to tax the public as much to pay back interest on borrowed money. Fundamentally, The New Abolitionism campaign is a monetary campaign to help liberate the public from the burden of debt on borrowed money.

Adam Simpson: Right, right. Well there’s a lot there I want to follow up on, but let me just ask you, what drew you to highlighting the monetary system as the key intervention in advancing social justice in the United States?

Delman Coates: I pastor in Prince George’s County, Maryland, right outside of the nation’s capital. It is a county that is known for having the highest educated population of African-Americans in the country and one of the highest income-earning, wealthiest populations of African-Americans in the country. Our community, our county like many others, was devastated in the aftermath of the global financial crisis. I saw an uptake of the number of people coming to the church needing emergency assistance to help avoid foreclosure. After having a series of foreclosure modification sessions here at the church in which we would invite elected officials, pro bono attorneys, and banks to help people stay in their homes, over time I really wanted to understand what caused this crisis in the first place. That’s really what got me started on this nine or ten years ago. What caused the global financial crisis?

As many people know, it was the way in which banks turned mortgages into a casino really by securitizing mortgages, selling them around the world, and to homeowners. We know all that subprime lending was the basis of the global financial crisis. That really started me on this journey to want to understand the money system. It was wrestling with the global financial crisis. I really regret that over the last ten years our nation, when we had an opportunity to stabilize the banking system [we didn’t] … I mean think about the Occupy Movement that was really at the forefront of the world in 2009, right? Focused on Wall Street, focused on banks. We’ve really gotten away from that focus. We have not seen Wall Street held accountable for the way in which they devastated the lives of Americans.

We really need to ask ourselves why is it that the very industry that caused the global financial crisis is now three times larger than it was in 2007, in 2008. While we are presently at a time where we’re seeing almost weekly record highs in the stock market, that success on Wall Street is not translating to good times on Main Street, and we have really got to figure out why it is that the wealth of the American people is being funneled to the top. I would contend it is because at the foundation of our economy is the ability and the power of banks, the monopoly of private banks to issue the medium of exchange as a debt to society. We can do better and should be able to redirect trillions of dollars of the nations wealth from paying interest payments. Think about it, the average American works 40 to 50 hours a week for what? To pay interest on a mortgage, most of which is interest, on a car loan, on a school loan, a department store credit card, and taxes, most of which are about paying interest.

I envision a world where we can meet all of the social priorities of the left, having a social safety net, healthcare for everyone, having decent public schools, protecting the environment, having a full employment economy, all the many priorities of the left. I believe we can do that while minimizing the tax burden. We can address both of these priorities by reclaiming the power to issue the nation’s money for the government of the people.

Adam Simpson: Right, right. I wanted to follow up, because you’re suggesting that instead of private banks making money, that [the government] do this in the public interest, if you will, the public good. I just want to point out that this isn’t actually a new idea, there used to be this concept of seigniorage for governments, correct?

Delman Coates: Yes. The intellectual foundation of the New Abolitionism campaign, despite the term New Abolitionism, is really not a new concept. Colonists did not want to remain in bondage to the money system of England. They were having great success, many of the colonies, in issuing their own script. Seigniorage, that comes from issuing money. That the benefit from issuing the medium of exchange should belong to the public rather than the private sector. Banks are receiving an unearned economic benefit. What do I mean by that? What many people fail to realize is that when banks profit in the form of receiving interest, private banks create that money out of nothing.

If you ask ten people, when you receive a mortgage, where did the bank get that money? If you ask ten politicians, ten activists, ten people on the street, they’re going to say, “Well I assume they get it from the vault, from savings.” Most people assume that banks lend based upon existing deposits, that’s called the loanable funds theory. The banking industry convinced the public that it is engaged in a legitimate business enterprise. Banks literally create the mortgage and we end up going into 30 years of interest servitude to the industry that never effectively loaned you anything.

If I loan you my cellphone, I have to have that cellphone first. Banks literally create the loan as an accounting entry, and as a result they receive an unearned economic benefit for labor that they haven’t performed. And as a result, the prosperity of the American people is transferred to the banking industry. There was a report I heard about that said 80% of the world’s wealth that was created last year went to the top 1% of gross population. We need to have a democratic money system if we’re going to have a democratic society, and so I’m really passionate about educating the public, educating elected officials.

I want to encourage those of you who are listening to call your elected officials, to do research about the monetary system, read books like Joseph Huber’s Sovereign Money, which just came out in 2017. Read books like Stephen Zarlenga’s The Lost Science of Money, go to our website, www.thenewabolitionism.org, go to websites like http://www.positivemoney.org, which is an organization based in the UK that’s really focused on these very same principles and concepts, research the Chicago Plan. It is critically important that we have an educated population of people who are understanding that the reason we have social injustice today, the reason we have inequality today, the reason we have the tax burden, social tension, the inability of state, local, and federal governments to fund all of our priorities, it’s not because we need a different tax scheme, it’s because the lion share of the nation’s wealth is going to pay interest on borrowed money. I would rather as a citizen focus on who is benefiting from the economic loaf, rather than arguing over how we’re going to allocate the economic crumbs.

Adam Simpson: I want to go back a little bit. I’ve heard what you said before referred to as the “debt virus” theory, that when banks lend money they put out the principle but they don’t put out the interest, et cetera. You mentioned that previously and this money scarcity dilemma. Another thing I’ve also heard is that banks have their own expenditures and leakages through the banking system, which would suggest to me not just expenditures from the bank but also salaries. Given that bankers’ salaries are known to be astronomically high, it would seem even with this system in place, we’re admitting that the process of seigniorage is not only a huge portion of bank profits, but also that the notion of trickle down economics is baked into our system with this money system.

Delman Coates: It is. Those who take issue with the money scarcity perspective on a current debt based money system, it’s based on a series of theoretical assumptions, right? It’s like, if banks reinvest all of the interest they receive, then we can conceive of the possibility of the public being able to meet all of this interest. As you’ve just noted, banks don’t reinvest all of the interest. It goes into the pockets of CEOs, and salaries, and things of this nature. All of this is taking money out of this system. There is no doubt that a debt-based money system causes and creates monetary scarcity that causes the range of social and economic issues we face today.

I have said in other places that our current money system reminds me a lot of musical chairs, where’s there not enough chairs for the number of people in the game. You know, it’s a fun game, Adam, until you don’t have a chair. I’ve done demonstrations where I’ve brought people on a stage, ten people with ten chairs, and I said, “Hey, when the music plays, I want you to walk around these chairs. When the music stops I want you to find a chair and I’ll give you $20, everyone $20 who can get a chair.” Adam, they walk around those chairs, they’re smiling, they’re helping one another. When the music stops they’re assisting one another. Why are they doing that? Because they know that that game is based on sufficiency.

When I start eliminating chairs, if I take two or three chairs away and I say, “Hey okay, I want ten of you to walk around these seven chairs, and when the music stops, those of you who are able to obtain a chair, I’ll give you $20.” Those same people, they can be the same race, the same gender, it doesn’t matter, the same group of people, their behavior will change. They’ll start pushing, they’ll start shoving, they’ll develop alliances to try to keep some out and others in. This is what happens to human behavior when they are forced to be in a context and an environment that is predicated upon scarcity.

If we want to address our nation’s greatest challenges and our greatest problems, whether it’s racism, sexism, the scapegoating of immigrants, then we need to address the money system because it’s the money system that causes structural scarcity in our economy, and, I would contend, pits groups against one another. I’m very passionate about the money system because if we’re going to address a problem, you want to address it at the root cause. Dr. King said something that I think was deeply profound. He said, “If a soul lives in darkness, sins will be committed. The guilty one is not the one who commits the sins but the one who causes the darkness.” He goes on to talk about the difference between causative injustices and derivative injustices.

I would contend that in our society today we’re focused a lot on derivative injustices in our society, but we’re not spending the amount of time we need to focusing on the causative injustices. I would contend that the money system is one of the foundational aspects of our society that’s causing systemic injustice at every level. We can do better. A lot of times when we talk about this whole issue of monetary reform people immediately go to, “Well—you’re opposed to capitalism. This sounds like socialism.” Nothing could be further from the truth. Monetary reform is really about having a true capitalist system where we don’t have a rigged arrangement, as in the current system, where banks are able to profit off the top. They’re not even playing the same rules as everyone else.

Monetary reform is not about imposing an economic ceiling on society the way socialism does, it’s about raising the floor. We can raise the floor in our culture and in our society by having a money system and an economy that works for everyone, rather than a money system that just works for the private banks. The money is ours. The public needs to ask itself: do you believe that the public should benefit from the existence of money, or should private banks benefit from the mere existence of money in our society? I encourage your listeners to go on YouTube and listen to the lecture by Martin Wolf, who is a chief economist for the Financial Times in London. He has this lecture you should search called, “Why We Should Stop the Banks From Creating Money.”

There’s so many macroeconomists, from Adair Turner to many others, who are saying the foundational issue in our society that’s causing so much of a problem today has to do with the power to create money.

Adam Simpson: Right. This power to create money, I guess what was interesting at The New Abolitionism symposium back in October of 2017… There were two panels, right? There was one panel of religious scholars, and then kind of religious takes on jurisprudence or ethics on a moral money system and kind of morals and finance. There was also a panel that featured a who’s who really of regulators and bankers, and people that were really involved in the banking industry. What was interesting to me is when you were speaking to them and you were asking them about these facts about money creation. From our understanding of the monetary theory, like it’s not that there’s money in the back of vault, it felt it was very difficult for them to admit this role of banks creating money.

Delman Coates: Well I actually think if you listen close enough, I mean those within the industry who know about the mechanics of money will admit, as they admitted at that panel, they said clearly, “Reverend, the money system does not work that way. It has not worked that way. That is a myth, right? The idea that banks lend from a vault somewhere.” They said it, you just have to listen, you know? Really closely. The benefit of that panel was that we have a host of politicians right now, Democrats and Republicans, who believe that banks function in a particular way, that they do not function. They believe that banks lend and don’t create money. They believe banks lend based on existing deposits. This then prevents politicians from focusing on the way in which banks have an unfair advantage in the marketplace by benefiting from money creation.

Adam Simpson: Yeah, sorry, I didn’t mean to interrupt. I just wanted to put out, it also affects, we just recently had this tax bill that was passed that did various things that… well suffice to say I disagree with, but the converse of that is that people view the government in a similar way, that the government has to collect tax money from the public before they can spend it when in fact the government in actuality does have this power to create money, as you’ve said.

Delman Coates: It does have that power and unfortunately because of the Federal Reserve Act of 1913, the government has given that power over to private banks. We can reclaim that constitutional power. The constitution says that Congress shall coin or create the medium of exchange. Congress gave over that power with the Federal Reserve Act of 1913 and in that same year created the Internal Revenue Service, right? It’s the taxation that was used as the means of paying the interest on this borrowed money. We have got to get to the point, particularly for those who are on the left, right? I mean money reform is not a part, it’s an issue, it’s for conservatives, libertarians, and progressives. For those on the left, and I identify as a progressive, we have got to move beyond this sort of only viewing taxation as our means of prosperity.

At every level there’s another vision for how we can fund all of the priorities of our society, and the only way for that to happen is for the government to reclaim the power to issue the nation’s money. If we did that, we could fund all of the public priorities, education, healthcare, we could do so in a way that incentivizes business development and is not anti-business. We could also reduce the tax burden. In my opinion, monetary reform and reclaiming the power to issue the nation’s money is the number one human and civil rights issue of our day.

Adam Simpson: Right, right. I also want to mention about the other panel of religious scholars that was talking about money, who turned out to be much more radical than the practitioners there, and certainly more progressive. Could you talk a little bit about the way that these religious communities, or I guess the scholars that were represented, how these people view debt and money and what that says to you?

Delman Coates: What many people fail to realize is that the major religions of the world, in particular the Abrahamic religions of Judaism, Christianity, and Islam, have had a historic position against usury. Usury was regarded as a sin. Now in the modern world, I would say in the last 300 years or so, usury has been misdefined as excessive interest, the charging of excessive interest. That definition of usury was used by Jeremy Bentham and others who are attempting to convince the Catholic church at the time to give up its historic doctrinal position against usury as sin. By defining usury as excessive interest, it caused the church and the public to get comfortable with some interest or a little interest, right?

Usury is not about having a debate around which percentage of interest is acceptable. Usury as Aquinas said, is the earning of interest on something that did not exist before. Very powerful. We heard some of that from Dr. David Cloutier from Catholic university at our symposium. The earning of interest on something that did not exist before. This is unjust, this is sinful. We read about how this is the basis of injustice. If there’s nothing more of a reflection of that, it’s our current money system where banks literally create the medium of exchange out of nothing, and receive ten, twenty, thirty years of interest from the public, from governments, taxes, received interest on that which did not exist before.

Your mortgage payment… The bank didn’t take it from the vault and allow you to use it so you could buy a house. The bank literally created that as a digital entry into a computer, it’s a function of double entry accounting—they are able to receive millions of dollars of interest and profit on something that did not exist before. Judaism, Christianity, and Islam have had a historic critique around usury and the way in which it put people in debt.

I wrote in the Huffington Post in April of 2017 an article entitled, Jesus and the Money System, in which I argued that in the last week of his passion, as portrayed in the gospels, there’s this powerful story of Jesus overturning the tables of the money changers, right? It’s probably the only story of where Jesus is getting angry and he’s overturning the tables of the money changers. Well, what is Jesus doing there? Why does he do this? Well, Jesus overturns the tables of the money changers, and it’s not a critique against commerce as is often stated, and it’s not a critique about the location of the commercial activity, as if had the money changers set up show 100 yards away, what they were doing would have been fine.

The issue was not the location of their activity, it was that the money chargers were effectively creating temple currency. In order for you to worship in the Jerusalem temple you needed a temple coin called the half shekel, or what the Hebrew bible calls the Shekel of the Sanctuary. You needed that coin in order to purchase animals to be sacrificed in the temple, in order to worship for Passover or whatever sacred holiday. If you came from Athens, or Rome, and you had some other local currency, you came to Jerusalem, you had to convert your local coin into the temple shekel in order to buy turtle doves, in order to participate in the temple economy.

Well, the money changers were issuing the temple shekel, that half shekel as a debt. A coin that barely even cost them anything to create and produce. It’s not like it was created of precious metals or anything, they didn’t really cost much to produce. Here’s what happened, hundreds of thousands of people were—and Jesus saw this—were coming to Jerusalem to worship in the temple, and they end up leaving worship in more debt that they came. An environment where those money lenders were issuing the principal amount of money, the money that was needed, but not the money owed, put those people in an inherently economic economically unsustainable environment and Jesus overturned the tables of the money changers, causing those leaders, religious and secular, to decide, “We really need to kill this guy.”

All of our major religions have had a historic position against usury. Unfortunately, Judaism and Christianity over the last 400 years have sort of lost or given up that historic critique. It’s been Islam and Islamic economics that has maintained its position against usury, called ‘riba’ in Arabic. I believe we need people of faith, of all backgrounds, and even those who don’t have a particular avowed religious faith, but the major religions of the world have had a historic critique against the debt and usury. It is deeply radical and most people need to understand that.

Adam Simpson: I remember from a conversation I had with an economist and historian, Michael Hudson, that in the ancient world, particularly in the Near East where these religions came from really, the notion of a debt jubilee was very common and it was very central to a lot of the systems in this region. Well, I think you advocate for a positive money system where instead of being based on debt it is created through, I would imagine, a democratic process. What would we do with existing debt? Would you have in mind the jubilee or how do you think that we should confront the debt problem in general?

Delman Coates: Well when we have a true money system and not a credit system, there’s a transition period in which taxes can be received to actually pay down the debt over a period of time. If you read pieces of legislation like the most transformative piece of legislation that’s probably out there on monetary reform in the States, the NEED Act, the National Emergency Employment Defense Act, which was proposed by Congressman Dennis Kucinich at the time in 2011, and cosponsored by Congressman John Conyers. If you read the NEED Act, and I encourage every person listening to me right now to go online and search the NEED Act, the National Emergency Employment Defense Act, which was designed to exactly what I’m sharing, to get us off of a credit system onto a money system.

Once we get on a money system, rather than a debt or credit system, we’ll be able to start receiving revenue and over time actually paying down the debt because you’re not continuing to borrow more and more, more and more money. I mean people, think about this, people credit President Obama for saving us from an economic collapse and depression. Perhaps that’s true given the tools that he had at his disposal, which is more borrowing, right? In a debt based money system, the only thing you can do is continue to borrow. What did we do? We borrowed 12 trillion dollars from 2008 to 2016, which is why the very institutions that caused the global financial collapse are three times larger than they are right now.

We need a revolution of understanding right now, because there’s a lot of conversation about financial literacy. People, banks that are out there teaching people, so-called financial literacy programs teaching people about paying off your credit cards, accelerating payment on your mortgage, and we have many of these courses and curricula in our church. Many of these are good concepts, but what they fail to take into consideration is that if every American did that and followed that advice, if every American paid off their credit cards, got out of debt, saved, didn’t spend, there would be no money in the system. There would be no money because money is debt and debt is money in a debt-based money system.

People wonder all the time, “Why do I keep getting these credit card offers?” And, “Why is my dead dog receiving a credit offer in the mail?” It’s because in a debt based money system the whole system is driven by credit and debt. What happens in a positive money system is you have a transition period where you’re actually using revenue or tax revenue to pay off the existing debt so that over time you don’t have that burden, and you have a true money system. Imagine people listening to me right now, being able to go to work 40 and 50 hours a week. Do you realize about 44% of a cost of goods is interest? Imagine if your $400,000 house only cost, I don’t know, 200,000 or 210,000, right?

Imagine if we had a true money system where you’re not going to work 40 hours a week to really just pay interest on your car note, your school loans, your borrowed money for your department store credit card, and your housing note, where you’re actually working for yourself. Imagine like the NEED Act says, imagine every household, every individual in the household receiving a $10,000 dividend, right? Per member of the household. A true money system, rather than a credit system. We really don’t have a money system right now. We have a credit system, a debt system, an economic slavery system where the public and governments are in economic bondage to those who issue the nation’s money.

We can do better, and I want to invite everyone listening to me right now to connect with The New Abolitionism campaign, go to newabolitionism.org, let us know you want to be on our contact list, send us an email, follow us on Twitter, Instagram, and Facebook. We’re right now in the midst of developing our website, I’m writing a book right now, a basic book, and a series of teaching tools we’re doing this year. I’d love to come to your school, your church, I’d love to come to your divinity schools, your seminaries, your civic organizations. As we endeavor to build a campaign of people of all faiths, all backgrounds, all races, all political affiliations, we need a unifying meta-narrative that focuses on what we share together in common as an American people.

The one thing that we share in common, regardless of your race, your gender, your creed, your color, your sexual orientation or country of origin, is money. We need to find a discourse that links us rather than specializing in discourses that distinguish us, as important as they are.

Adam Simpson: So there are people that think that instead of a positive money system, that they would prefer that the banks that have this unilateral power to create money be managed democratically in the form of a public bank or alternative forms of bank that are either at the local level, in municipalities, or in states, or in regions, are controlled through democratic participatory processes. How do you view that notion? Is that way of approaching the problem sufficient to you, or what’s wrong with that approach?

Delman Coates: I am open to having a conversation with a range of money reformers in society today. My understanding of public banking, and I don’t know a lot about it, is that it’s still predicated upon the current money creation mechanism. Our campaign is about changing the mechanisms for creating money. My understanding is, and I want to confessionally state that perhaps I’m wrong, is that the current public banking movement does not change the mechanisms around which money is created in our society. It does propose a kind of democratic way for allocating debt-based money. I want to change the mechanisms around which money is created in the first place.

Additionally, I come in contact with folks from around the country who are focused on local currencies. The local currency movement is a major movement in America as well. I think that these kind of complimentary currencies are great and are fine, but I think they should exist within a macro economic environment in which money is created by the public without the debt or interest obligation. If we just have local currencies but we leave in place the current debt-based money system, then we are focusing people to participate at the local level in an environment that is unsustainable. I want to change that macroeconomic environment in which we’re all forced to live in.

Adam Simpson: Now, and I think, I mean just as we come to a close, is there anything about the monetary system, about debt and the current credit system we have that we haven’t mentioned today that you would like to impress upon our listeners?

Delman Coates: What I would say is that people need to understand that banks don’t lend money, they create money. That power should not belong to a private industry. That power should belong to the government of the people. I understand that government is not perfect, and I understand that private interests historically have done effective job in demonizing government, but government has a role. I think that the public needs to understand that banks do not lend money, they create money. The power of money creation should not reside in a private industry that profits from that power. The power to create money should belong with the government of the people, and that money should come into existence with the interest obligation.

Adam Simpson: Well thank you again to my guest today, Rev. Dr. Delman Coates of Mt. Ennon Baptist Church. I would secondly encourage all our listeners, as Reverend Coates did, to go to www.newabolitionism.org, follow New Abolitionism on Facebook, Twitter, and Instagram. Dr. Coates, thank you again for joining me today.

Delman Coates: Thank you so much for having me.