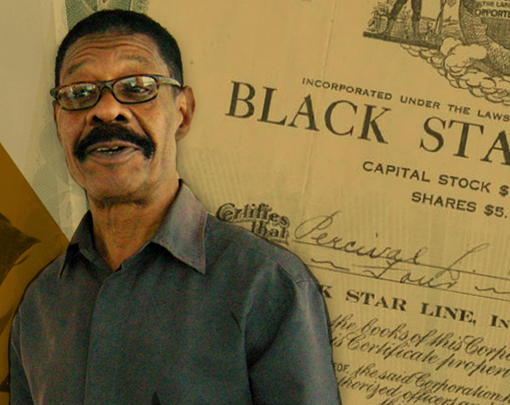

This week, we’re talking about how Social Wealth Funds can play a role in empowering both individuals and communities in the economy. Joining us is Maryland House of Delegates member Gabriel Acevero, Vice President at the Insight Center for Community and Economic Development Jhumpa Bhattacharya, and President of the People’s Policy Project, Matt Bruenig.

The Next System Podcast is available on iTunes, Soundcloud, Google Play, Stitcher Radio, Tune-In, and Spotify. You can also subscribe independently to our RSS feed here.

Adam Simpson: Welcome to the Next System Podcast. I’m your host, Adam Simpson. Today we’ll be talking about social wealth funds with three very great guests.

First up we have delegate Gabriel Acevero, who is a union organizer, a political activist, who is currently serving as a delegate in Maryland’s 39th House district. Gabriel, welcome to the program.

Gabriel Acevero: Thank you for having me.

Adam Simpson: We also have Jhumpa Bhattacharya, who is the vice-president of programs and strategy at the Insight Center for Community Economic Development, where she leads work on racial and economic equity. Jhumpa, thanks for joining us.

Jhumpa Bhattacharya: Thank you for having me.

Adam Simpson: And finally, we also have Matt Bruenig, founder and director of the People’s Policy Project, and author of a proposal called “Social Wealth Fund for America.” Matt, glad to have you.

Matt Bruenig: Thanks for having me.

Adam Simpson: Let’s just jump right in. Matt in your own words, how would you define a social wealth fund?

Matt Bruenig: A social wealth fund is a collectively owned financial fund, the returns from which are used for social purposes. It could be used to provide a check to everyone, as is the case for Alaska, which has one of these programs. It could be used to fund other social programs, education, housing, whatever, as you see in some other countries like Norway, which has a social wealth fund. The best way to analogize it for those who are familiar with similar concepts is to think about an old-school pension fund, where you have either a company or the government who has a big pile of financial assets and they use that to help fund people’s retirement. This is very similar to that except instead of funding a specific group of workers’ retirements, it would be used to fund other kinds of social things. It wouldn’t be pegged specifically to retirement. So that’s the basic gist. A financial fund that is owned by the people and whose proceeds go to benefit the people.

Adam Simpson: Is there a way that I should be differentiating between a sovereign wealth fund, which is something more people have heard of, and a social wealth fund? Is there a key difference there?

Matt Bruenig: Yeah, there are a lot of different names for it. There’s “social wealth fund,” there’s “sovereign wealth fund,” there’s “citizens’ wealth fund.” The social wealth fund terminology comes from a book written by Stuart Lansley, and he basically distinguishes based on what the wealth fund is used for, so a sovereign wealth fund could be anything. The Saudi royal family has a big sovereign wealth fund, the returns from which it’s hard to say that they’re used for good social purposes. So it’s, what are the proceeds used for? Is it used for social good, or is it used for some other purpose of the sovereign, maybe to regulate currency values, or perhaps to enrich the royal family or something like that?

Adam Simpson: Gabriel, you recently proposed the creation of a specific type of social wealth fund in Maryland. Can you tell us a bit about your proposal?

Gabriel Acevero: Sure. This past legislative session, I introduced House Bill 1089, which in essence would have established a social wealth fund to be called the Maryland People’s Fund. In essence, what it called for was 25% of the revenue from the tax on the sale of medical cannabis to be placed in this non-lapsing fund, not to be touched for a period of seven years, and as with all of the state funds, our state treasurer would invest those funds into a number of portfolios and the proceeds from which, our hope was that within the next five, 10 years at the most, we would be able to pay out our first citizen dividend or universal basic income to every individual in our state, of course, prioritizing low-income families. The impetus for that was a number of things, not just automation, but the fact that we wanted to get money back into the hands of the people without it, and we also wanted to get people an opportunity to provide for their basic needs.

As was mentioned, there are a number of jurisdictions that have implemented universal basic income, most notably Alaska, but we see other jurisdictions as well. The state of Hawaii passing a bill to study universal basic income, laying the foundation, and the city of Stockton [in California] is looking at it from a public/private partnership, and so for us in Maryland, it was part of a conversation of not just managing poverty, but eliminating poverty. As we know, universal basic income or guaranteed income, as Dr. King and so many other freedom fighters have described or called it, would have in essence, provided every Marylander with a check to meet their basic needs and to in essence give them that kind of economic relief that oftentimes they don’t have, they don’t get, but desperately need. And so that was the impetus for the bill, wanting to not just manage, but eliminate poverty, but also recognizing that this puts more money back into the hands of working people and allows them to patronize the very institutions within their communities, thereby stimulating the economy. As we’ve seen from other places, other countries that have implemented universal basic income, it decreases stress. It decreases the kind of economic anxiety that a lot of working people have right now as it relates to our economy.

Adam Simpson: Jhumpa, I know that you offered written testimony to support this bill, I should say as I and I believe Matt did as well, so we’re all on the same side here, but I do want to ask, could you say a little bit why you want to support this particular social wealth fund, and just a bit more broadly about the potential that you see in social wealth funds.

Jhumpa Bhattacharya: Yeah, absolutely. I work at the Insight Center, which is a national economic and racial justice research and advocacy organization. We’ve done a lot of work on economic inequality, and we’re one of the major pioneer organizations that brought racial wealth inequities, commonly referred to as the racial wealth gap, to the national conversation. So we really see economic inequality as inseparable from racial inequality. The wealth differences between white people and people of color nationally is wider than it has been in 25 years. In 2016, white households held 10 times more wealth than black households and eight times more wealth than Latinx households. And then further, when you look at Baltimore, Maryland, due to racist historic and present-day policies and laws, the typical white household with a high school diploma has $67,000 in wealth compared to black households, who have zero wealth. White households in Baltimore with a college degree have over six times as much wealth as comparable black households.

We supported this bill because we saw it as a really, really important steppingstone in helping address massive racial and economic inequality in Maryland. I want to say that we don’t think that one policy is going to be a panacea for solving this really big problem, where again you did see this as an important stepping stone,. Lastly, I’m just a really big fan of giving people unrestricted cash, particularly to black and brown communities. I think it helps provide a sense of agency and control, which many of our current government policies and programs tend to strip away, and giving poor people of color cash with no restrictions sends a message that we actually trust them to know how to use the money best for their families and that we trust them to make the right decision. That, quite frankly, is a revolutionary concept in America today. I think that we are obsessed with controlling the behavior of poor people and black people specifically. We constantly question and undermine their humanity, their deservedness, and their ability to love and care for their families.

Adam Simpson: I want to follow up a little bit on that. You mentioned that you viewed, particularly the basic income component as a stepping stone toward more broadly confronting the racial wealth gap. I wanted to know, in terms of being a stepping stone, a little bit more about that path, and do you have a sense of what role a basic income would play in a broader, progressive agenda toward rectifying that larger issue? What role would a UBI play within that?

Jhumpa Bhattacharya: I think any kind of guaranteed income policy, call it UBI, a social wealth fund, does a very specific thing. And I think what it does is that it does alleviate abject poverty. And it does, again, give people cash, which is much needed, particularly for black and brown communities who are disproportionately poor. But that in itself is not going to solve racial wealth inequalities. So I think that’s important to really clarify the differences between income and wealth. So income is a part of wealth, but it’s not the only thing that contributes to wealth building. I think that we have to acknowledge that it took a bunch of different types of policies to get us to the place that we are today where we have such massive economic stratification on race and gender lines, quite frankly, and it’s not going to be just one policy that’s going to get us out of it, and it’s not going to be just money. We’re going to have to deal with racism in general, and we’re going to have to also look at racial wealth-stripping that’s happening, particularly with the criminal justice system. So even if the government is giving money with one hand, if it’s taking it away with the other, primarily through things like predatory lending, through money bail, and fines and fees in the criminal justice system, we’re going to continue to see massive inequality because the money’s just being stripped away from black and brown communities. I think that we have to have a truth-and-reconciliation process on race. There’s just a lot that needs to happen if we’re really going to tackle racial wealth inequality in the United States.

Adam Simpson: Absolutely. Matt, you authored a proposal called “Social Wealth Funds for America.” We’ve heard about what a social wealth fund might look like for a state like Maryland. What does a social wealth fund look like at a national level?

Matt Bruenig: The basic outline of it is pretty similar. You create a new fund, like a pension fund, or a mutual fund, or other kind of financial funds. That fund is going to be administered by the governments, by the Treasury Department, maybe by the Fed; different countries have approached this differently. But you create this big fund. In my proposal, every person gets one share of ownership in the fund, so you would get some kind of paper share or something that would indicate, hey, you own one part of this. Everyone would own an equal share of the fund, sort of nominally. And then from there, you’ve got to fill the fund up with assets. That’s step one: how do we get money into the fund, what do we buy, and that kind of thing. My proposal lays out I think, something like 15 different possibilities. One possibility is to have the Federal Reserve, whenever it’s expanding the money supply, instead of buying up Treasury bonds as it does now, it could buy other kinds of assets.

So right now, when the Federal Reserve wants to inject more money into the system, it creates new money, and then it goes and buys Treasury bonds out of the open market, and then it holds on to them, and so why not instead have it go buy corporate equity or have it go buy bonds, or have it go buy real estate. This is what the Bank of Japan’s been doing for the last 10 years, and the Bank of Japan now owns something like 5%, 6%, 7% of all Japanese companies. It just keeps going up year over year. Another approach, and this was actually proposed recently in Germany, is to have the federal government borrow money, and then use the borrowed money to buy other kinds of assets. The federal government can borrow for pretty low interest rates, 2%, 3%, depending on where we’re at. But return on equities is something like 7%, 9%. So you can take advantage of that spread between the return on government bonds and the return on equities in publicly owned companies. That’s free money almost that you could use to pay out dividends. And there’s been a lot of talk in Germany recently of doing that because they’re a government that trades still at a negative interest rate. So you’re leaving money on the table at that point. Then the last approach that I’ll go through here is that just generally taxes. Right now wealth in the United States is about $100 trillion of wealth if you add it all up—stocks, bonds and real estate, and about three-fourths of that wealth is owned by the top 10%. The bottom third owns literally none of it on net, and then you have the small middle class that owns the rest. So any kind of levy on wealth is for the most part, is going to draw from the wealthiest people.

So I have a number of proposals. One would be to have what is called a scrip tax. You could go to companies and say, “Every year I want you to pay 0.5% of your market cap into the fund. And you can satisfy that by giving us shares of ownership. You don’t have to give us cash.” And so you think about it. After year one you own 0.5% of every publicly traded company in the US. After year two, it’s 1%. After year three, it’s 1.5%. And you’re slowing grabbing up ownership of these companies, and the people who are being displaced, who are losing out on it, are the people who currently own these companies, which are for the most part the wealthiest people in the world. And a lot of little taxes like that.

How about an inheritance tax? That’s actually the primary mechanism through which racial wealth gap gets transmitted historically. White people have built up a lot of wealth inside their families and they transmit it down generational lines. Black and Latino people have been prevented from building up this wealth, and so it perpetuates itself. Why not at the point of inheritance, grab a decent chunk of that, put it into the social wealth fund, which we all own an equal part of, and then it becomes like a collective inheritance.

I’ll go on and on, but that’s the basic gist. You either tax the wealthy, or you can use these mechanisms of borrowing and of the Federal Reserve operations to build up the funds. From there you invest in normal assets. You get dividends and you pay the dividends out to every adult American, just like they do in Alaska. That’s the proposal as I put it forward, and you can change different pieces of that or different flavors of it that exist around the world, but that was what my paper went with.

Adam Simpson: Jhumpa, I know that you have written about social wealth funds in the lens of racial equity. I’m referring to a piece you co-authored with Ann Price, also at the Insight Center, and I just wanted to ask, when you’re thinking about social wealth funds, are there specific design criteria that you would want policymakers to be aware of when they’re designed a social wealth fund with racial equity in mind?

Jhumpa Bhattacharya: I think that before we start any policy discussion, we should always be asking ourselves the question, what is the problem that we’re attempting to solve, and who are we targeting through this intervention as a result? So it’s that “for what” and the “for who.” So for looking at a social wealth fund as an answer to massive economic inequality, I think we have to design and implement the policy to solve that problem. And while I do think that social wealth funds, as I say earlier, can do a lot to alleviate abject poverty, I think that we can and should be striving for more. So any economic policy put forth in this moment must take a racial equity approach by accounting for the ways in which black and brown communities have been blocked from gaining economic prosperity and therefore have much less wealth than white families. As a result of this massive wealth inequality, we have to acknowledge that the outcomes of a dividend would impact people very differently based on their wealth position.

To me this would mean that everyone actually should not receive the same amount through the dividend, and I want to talk about why. If all people were provided the same dividend or the same amount, I think the outcomes would still keep a highly, deeply inequitable society. For financially strapped families, who disproportionately can mean communities of color, money from the fund would do things like help keep the lights on, put food on the table, finally pay for a much-needed car repair or home repair, or pay off some sort of debt. And I think that these are really, really important stop-gaps, but they’re not wealth creation. And contrast a dividend for higher income families that might allow them to save, or invest in asset-building activities such a buying a house or contributing further to a retirement fund because their basic needs are already met. So I think it’s really important to understand how different families, based on their wealth position and incomes, what the extra money or dividend, what they’d be doing with that money, what they’re going to be using it for. So I think that while a uniform dividend does seem more politically palatable—I get that—I believe that we can and should be aiming for higher. I think this can be used as an opportunity to really investigate and, as a national conversation, really understand why we have such massive differences in wealth between races, ethnicities, and gender, and again have a truth-and-reconciliation process that acknowledges the role that government has played in the past in creating those wealth opportunities for white communities and has blocked it through things like redlining, predatory lending, Jim Crow, and modern-day wealth stripping through our criminal justice system as I talked about before.

Adam Simpson: Gabriel, when you proposed this social wealth fund in Maryland, you have to pitch to the Ways and Means Committee. I think this is a big question for a lot of people that might be interested in social wealth funds, which rears its head in every policy discussion: How are you going to pay for it? In the case of the social wealth fund, the question, of course, is how to capitalize it. And as you said, your previous bill, you wanted to use a portion of the tax revenue from the sale of cannabis to capitalize the social wealth fund. Have you thought or investigated other ways that one might capitalize a social wealth fund, and do you have any other thoughts on other sources of revenue for the social purpose that a social wealth fund might be needing?

Gabriel Acevero: The reason I looked at the marijuana industry is because, one, before I came to the state legislature, we legalized medical cannabis and we all know the relationship of communities of color to the intentional war on drugs and what that has done in terms of decimating our communities, leaving us economically deprived. A lot of homes without parents, and just getting caught up in the prison industrial complex, and so given the relationship of communities of color to marijuana, to me it was important to tie the social wealth fund to that because a majority of low-income people in our state and nationally are communities of color. I think it is an industry that is poised to make billions, and the people who are poised to make those billions don’t look like the people languishing behind bars, the people who are second-class citizens right now, who are still languishing in poverty. And so this was part of a deeper dive into what equity looks like within the medical cannabis industry, but also what do we intend to use this revenue for, because there was a lot of discussion in our state capital of Annapolis about what we’re going to do with the revenue from the medical cannabis industry. Our state projected that we would make roughly $44 million from the cannabis industry last year, and we ended up making $94 million to $96 million. So it performed way better than we projected or expected and I think it’s important that when we’re talking about this industry, and the revenue and its relationship to communities of color, we have to ensure that we are righting the wrongs of history, and we’re prioritizing the people who have been hurt most by the criminalization of marijuana and this industry.

So we wanted to create a social wealth fund, and unlike Alaska, we do not have an extractive sector, and so a number of things came to mind on how we can capitalize this fund right from a tax on wealthy Marylanders. Maryland has a very archaic tax code. Our poor are taxed more than our rich and it’s really emblematic of what we’re seeing nationally, and the people who feel the biggest pinch are communities of color.

I’ll give a couple of examples. The poorest 20% of Marylanders, and those are with incomes below $24,000 per year, pay an average of 9.7% of their incomes in state and local taxes, whereas the richest 1% of Marylanders, that is folks that are making at least $481,000, whose average income is about $1.6 million, they pay only 6.7% of their income in state and local taxes on average. What we know is that African-American Marylanders are nearly twice as likely as white Marylanders to be among the poorest 20%. What we also know is that by contrast, white Marylanders are almost twice as likely as African Americans to be in the richest 20%. In addition to that, you have black and Latinx Marylanders who are more likely to be in an earning bracket that pays more in taxes as a share of their income than whites. So we were looking at that first, but also recognizing that we have a pretty conservative and centrist Ways and Means committee, and just being honest, understanding that a lot of the tax policy and tax credit-related bills that have come out of that committee have been pretty regressive. And so we wanted to look at that, but we also wanted to look at the marijuana industry because of its relationship to communities of color.

So I felt, given that fact that the conversation was being had around the marijuana industry, what we use revenues for, and I was pretty disturbed by the conversation that was being had about this, and what we were planning on using the money for. And long story short, none of it really centered or focused on communities of color, people who were hurt the most, and the people who should benefit the most from the legalization of medical cannabis and so we decided to use the revenue from the tax on the sale of medical cannabis in this instance to not only draw attention to the injustice of the industry but to also point out that majority of low-income people are people of color and we have to prioritize them as was rightly pointed out by Jhumpa when we talk about universal basic income. So we’re going to be looking at other ways because we don’t want to just look at the medical cannabis industry to be capitalizing this fund. We want to have a diverse pool of resources to put into this social wealth fund so that we can prioritize low-income families across our state.

Adam Simpson: Absolutely. And now, I want to talk about maximizing the impact of a social wealth fund. Jhumpa, as you talked about, there are different points at which a social wealth fund might touch your average citizen and a community. So when we talk about capitalizing it on the tax side, that might impact the community when we’re talking about the investments that the fund itself might make, those investments could have a significant impact on communities. I know, for instance, there are sovereign wealth funds where basically their investment strategy is just to maximize returns, which maybe is okay; it’s pretty agnostic about the community. And then finally there’s obviously the dividend itself, what to do with that, and I wanted to ask, maybe specifically about even the investment components. Is there a way that you see that a social wealth fund might be impacting communities, how we maximize the impact at different stages, particularly at the investment stage, I would think.

Jhumpa Bhattacharya: Again, I think one of the things that don’t get talked about enough within this conversation around guaranteed income or social wealth funds or just cash programs is this sense of agency and the dignity that it can provide to low-income people and people of color in particular. I think that that is a community impact that gets underplayed, and we should be talking about it a lot more. Because as I mentioned before, the way in which our society is structured now, and particularly our government policies and programs, it’s so restrictive; it has so many restrictions on behavior because we have this obsession to control poor people’s behavior, because we have this mantra or this frame of thinking that it’s your fault that you’re poor, it’s your fault that you’re in the situation that you’re in, so it’s this notion of personal responsibility. We don’t look at systems because of that. I think just providing unrestricted cash can do so much psychologically to a community. So it can say that I trust that you know what to do with this money for your families, and that in itself is so freeing. I think that that’s a part that doesn’t get talked about enough, so to me, I just wanted to say that that is part of the reasons why I really believe in and am behind guaranteed income programs. I’m quite honestly not versed enough in the investment side to talk coherently about that, so I think Matt probably has much better ideas about that than I do. But I think in terms of the impact at a human level on community, I’m an organizer at heart, that’s where I come from, and you state you’ve organized and I’ve done a lot of qualitative work just through focus groups that are talking to poor people of color about what they need, and the number one thing that they always talk about is cash and trust, and the ability to make decisions for themselves. And I just again can’t overemphasize how important I think that that is.

Adam Simpson: Turning to Matt, and feel free to jump in on the potential there of investment, but one of the reasons that we’re really interested in The Democracy Collaborative in the social wealth fund model, it gets, as you were suggesting, at a certain point to where the community becomes an owner of a sometimes modest, but sometimes potentially significant part of the economy, and it really gets to a question of governance. Do you have any sense of how to make these funds democratic and accountable to the people and things like that?

Jhumpa Bhattacharya: Sorry. Matt; I did not mean to step on your toes. I will say that I think that there’s a potential with the governing council of really bringing communities to the table to decide how they want to spend money. So there’s a coalition called the Divest/Invest Coalition that’s doing remarkable work and really saying, “Commit your community to do people’s participatory budgeting,” and saying, “Here’s money that can come into a community. What do you all want this money to be spent on? Is it to build prisons, or is it to build infrastructure? Is it to build homeless shelters, or mental centers to help people who have mental behavior problems, or is it to, again, to constrict people’s behavior and put them in prison? Is it to have cops at your schools or is it to have counselors in schools?” I think that really bringing community to the table to decide how money can be spent, again, is amazing and is something that’s deeply missing in the way we structure programs right now.

Matt Bruenig: If I could chime on that particular point there: There is actually a social wealth fund in New South Wales, Australia, which is their biggest state, the one that contains Sydney, that they just started a couple of years ago. It’s a social wealth fund, it’s invested broadly, but they have something called the My Community dividend program. I’m not sure how they do it, if they break it out by neighborhood or whatever, but there’s a dividend that comes through and the dividend is not given to individuals to spend as cash, but it is given to communities to participatorially budget, so they can decide to spend it on this or that project. And you could have a hybrid, where some of the dividend is distributed as cash, some of it went into a community to decide through this participatory budget process, but there’s so many flavors possible with the social wealth funds, including the participatory budget dividend approach, on the benefits side.

On the investment side—not just what good can we do with the money that comes out of it, do we give it to people, do we spend it this or that way—what can we do on the investment side to achieve social goals as well? I’d say there are basically two aspects of this.

The one is deciding what to invest in, and some funds just take a broad approach, Alaska seems to take this approach; it’s just, invest in what makes money, don’t think too much about it. And then you have approaches like Norway has, where they have an ethics council, and they have over the course of 10 or 15 years created new rules for the ethics council and those rules control the fund. So they don’t invest in tobacco, I think they don’t invest in guns, they don’t invest in companies that have human rights violations. They have, I guess, a product-based exclusion for bad products and I think they got very close to divesting entirely from fossil fuels recently. Then they have conduct-based exclusions for companies that have been doing bad conduct. So in that way you have a divestment ability inside the fund to divest from certain companies, and to the extent that divestment works, that could work to help a little bit.

The second part of it is not what you invest in, but what you do as a shareholder of a particular company. Because if you own a lot of shares of a company, now you have rights. You get to vote at shareholder meetings. You get to elect the board. You get to elect the CEO. And that’s the other way you can do that, and so you can also adopt certain rules around that. You can say we’re going to prioritize transparency. In Norway they have a policy on CEO pay packages and if a company puts up a CEO pay package to a shareholder vote and that CEO pay package is beyond what Norway wants it to be, based on their rules of what they think ethical CEO pay is, they vote it down. So you have power as a shareholder in that sense. And so, yeah, that’s a sort of old, socialist dream of it, if you will. It’s not just that you get money out of it, which is probably the most beneficial thing to regular people who on a day-to-day basis need to pay their bills and need to be able to save and whatnot, but that you also are able to control companies to some degree. We’ve seen for instance in Norway, that the state of Norway owns one-third of all the corporate equity, the domestic corporate equity and owns 60% of all wealth in the country. And so you end up having a lot of power, and assuming you have a democratic government that is responsive to the people, which seems to be the case in Norway, maybe less so in the US, then you really do have something cooking there, where one person, one vote translates into some level of control and power over industry.

Another thing someone else proposed on this, I should add, is you could also use the investment funds to target certain things. I think some people have said, why don’t you use the money to invest in worker co-ops. They’re like processes where I guess you need to transition existing companies to co-ops and there’s some money to be made in doing that and so the wealth fund could go and help them become the owner of it, and in the process finance it and make some return off the finance and then it’s sort of a win-win. The social wealth fund gets to make a return, and then eventually the business becomes worker-owned at the end of the process, so that gets you two bites of the apple in terms of bringing ownership of industry into worker or collective or social control. You could imagine investing in certain housing projects or things like that, that have return possibility, but maybe other funds are less willing to invest in.

It’s definitely a possibility to both make an impact on the investment side—on the ownership side, as a shareholder—as well as on the benefit side, once you get the cash out of the fund and you’re spending it or giving it to people to spend.

Jhumpa Bhattacharya: Dan, I would just add that because we’ve seen historically communities of color being left out of decision-making bodies and institutions, whatever mechanisms we can put into place around a social wealth fund that allows communities to have control over how money is spent is a win. Just deeply believing that the people that are most impacted often have the answers rather than it’s people in ivory towers that have the answers, coming with that frame I think is very empowering and one that holds true to the racial equity approach.

Adam Simpson: Gabriel, we were all sad to hear that your proposal for the social wealth fund, the Maryland people’s fund, didn’t make it to a floor vote, but it was clear that when you presented it there was a lot of interest in the idea from the members of the Ways and Means committee because it was one of the experiences where people were at the end of the day, but suddenly there was a lot of energy and a lot of people wanting to ask questions about the proposal. Do you have any thoughts about another iteration of this bill, of what the future of your proposal might look like?

Gabriel Acevero: I think there was quite a bit of interest from my Democratic as well as Republican colleagues on it. I think what dismantled Republican opposition to it was the fact that universal basic income was actually introduced twice in the United States Congress in the 1970s by President Nixon. It was a Republican state legislature in Alaska, in fact the Libertarian wing of the party that advocated for and passed universal basic income in Alaska, and the fact that for folks on the left, you’ve had people like Ella Baker, Dr. Martin Luther King, as part of his poor people’s campaign advocating for a guaranteed income. The economic bill of rights that was introduced many years ago but unfortunately did not pass, also included in addition to a job guarantee, a guaranteed income or universal basic income, so we see that this is an idea that is welcome on both sides of the political divide.

I think the difference is that Republicans tend to advocate for universal basic income, while also trying to strip away the aspects of the social welfare state. So if we’re giving people money, then we do not need to give them subsidies in terms of child support or this or that, without recognizing that we need a strong social safety net that includes universal basic income, that includes tax credits for child care, that includes earned income tax credit, that includes a living wage, indexed inflation, so when we’re talking about lifting working people up, it’s not a one solution but a myriad of solutions working together to lift working poor people and give them the kind of autonomy and agency that they deserve. So I think it resonated well with a lot of my colleagues on the Ways and Means Committee, but I think the political will wasn’t there this session. But we are organizing, and we’re educating not just my constituents, but since we’ve adjourned our 2019 session I’ve been traveling across the state speaking in various districts in collaboration with a number of organizations about universal basic income, what we’re hoping to accomplish and why it’s so important for us to look at a number of ways to capitalize that fund, not just the medical or recreational cannabis industry, which we’re looking at legalizing in the state of Maryland within the next year or two, but also how do we ensure that those who can and should pay more in terms of taxes are paying more and we’re diverting those funds to the Maryland People’s Fund.

I just provided earlier a number of stats of what black and brown folks paid as a share of their income compared to those who are considered the 1% who earn even more, and I think that’s an injustice that requires us to not only look at our tax code but ensure that people who should are paying their fair share. We’re diverting those funds to good use such as a social wealth fund. I’m also looking at a carbon tax, and I was talking with a group of students about the Green New Deal and just how we can get to that point in the state of Maryland. We cannot have a conversation about our environment and about environmental justice without talking about a tax on carbon. And so I’ve also floated that idea to also divert funds to the social wealth fund, so we’re looking at a number of ways to get money into the fund so that we can get it into the hands of people. From cannabis to a carbon tax to a tax on wealthy Marylanders who have not and still aren’t paying their fair share, I think there’ll be several iterations of this bill that we’ll be looking at, and we’re also looking at not just giving people money, which we would like to do, but also creating a similar social wealth fund or using the one that we’re trying to establish, to help those struggling with childcare. So we’re looking at a number of ways. I’m optimistic about it. We’re starting the conversation, so there are so many iterations that I see for this bill. I’m really excited about it and I think it really opens up a conversation about a number of other issues that impact our community, and ensuring that those who should be paying more are paying more, and we’re also diverting those funds back to those economically depressed communities who need it.

Jhumpa Bhattacharya: I thank everyone for taking time to tune in and listen to the podcast. Thank you, Gabe and Matt, for engaging in a great conversation with me.

Matt Bruenig: Thanks, everyone.

Gabriel Acevero: Thank you again to the conveners of this conversation, and to the folks that participated. Really enjoyed it, really learned a lot and clearly shows that we still have a lot of work to do in building that just society and economy. So thanks for having us.